How to Negotiate Smarter as an Executive: Equity vs. Cash Strategies That Actually Work

TL;DR

Negotiating your executive compensation package is about balance, not just chasing the biggest number.

- Cash vs. Equity: Cash provides stability and liquidity. Equity offers upside but comes with risk.

- Understand the Equity: Know the type (RSUs, stock options, performance shares), vesting terms, and tax implications.

- Match Your Goals: Need short-term cash flow? Prioritize cash. Confident in the company’s future? Lean into equity.

- Negotiate Thoughtfully: Research market rates, model scenarios, and present a data-backed, collaborative counter offer.

- Consider the Company: Public vs. private firms offer very different comp structures and risk profiles.

- Prepare and Communicate: Know your must-haves, ask the right questions, and keep the tone aligned and professional.

- Manage the Risk: Equity is an investment. Know the burn rate, cap table, and your place in it.

Bottom line: There’s no perfect offer, only the one that fits your life, goals, and risk tolerance.

Introduction

When you're operating at the executive level, negotiating your compensation package isn't about picking the highest number on the page. It’s about building a deal that supports your current lifestyle and your long-term wealth goals.

More often than not, your executive compensation package will include both cash compensation and equity compensation. Understanding how to evaluate and negotiate these components is one of the most important financial decisions you'll make in your career. Executive compensation should be viewed holistically, including cash, equity, bonuses, and benefits.

I’ve coached many senior leaders through these high-stakes negotiations, and I’ve walked this path myself. In 2020, I negotiated my own total compensation package at Amazon, using tools like this one to weigh equity offers, base salary, and cash flow side by side. These tools help quantify the real tradeoffs behind every offer.

If you're at this point, you've had some great interviews and got the offer. Now, let’s break down how to negotiate executive compensation like a pro.

1. Know the Tradeoffs Between Equity vs. Cash in Executive Compensation

Most executive compensation packages contain both cash and equity, but that doesn't mean both are created equal. The split between the two impacts everything from your monthly cash flow to your future net worth.

Liquidity vs. Upside

Cash compensation (e.g., base salary, cash bonuses, sign-on bonus) is guaranteed, predictable, and immediately accessible. It gives you the financial freedom to manage real-life expenses, invest elsewhere, or simply sleep better at night. Cash compensation provides immediate and tangible rewards that can be used without delay, while equity compensation often requires time before it can be realized as liquid cash.

Equity compensation, on the other hand, often carries more upside. In the best-case scenario, your stock options or restricted stock units (RSUs) could be worth millions over time. But it’s not liquid. And it’s not guaranteed. Equity stakes can lead to significant wealth accumulation, especially in successful companies, but if the company fails, the employee may receive nothing.

Think of equity like this:

“How much of my annual income am I willing to bet on this company’s future?”

If you’re supporting a family, paying off a home, or preparing for a large life change, more cash might be the right answer. If you’ve built a financial cushion, have a high risk tolerance, and believe in the company’s trajectory, then more equity could be a smart investment. Understanding your personal financial needs is crucial when determining your risk tolerance during negotiations.

2. Understand the Equity Compensation You’re Being Offered

This is where many executives trip up: equity offers can sound impressive on paper, but without context, they’re hard to evaluate.

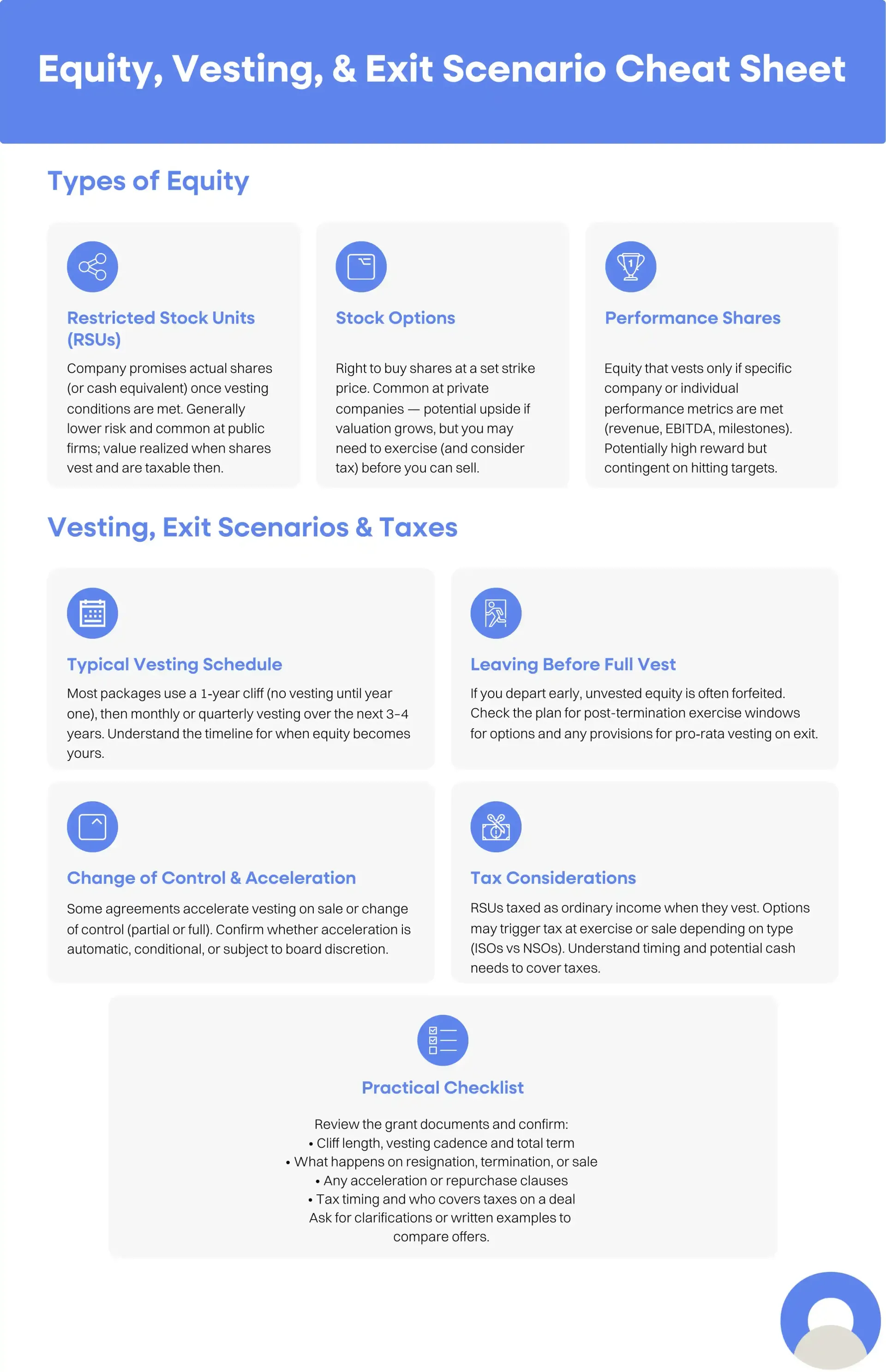

Types of Equity

Here are the three most common forms of equity compensation you might see in your executive compensation package:

- Restricted Stock Units (RSUs): You receive actual shares (or cash equivalent) once they vest. These are most common at public companies and tend to be lower-risk but also have less upside.

- Stock Options: You’re granted the right to purchase shares at a specific strike price (or exercise price). These are common in private companies and offer bigger upside... if the company grows.

- Performance Shares: Equity that only vests if certain performance milestones or metrics are achieved (e.g., revenue targets, valuation goals, etc.).

Vesting Schedules and Exit Scenarios

Don’t just look at the number of shares. You need to know when and how you’ll actually receive them:

- Most plans include an initial one-year cliff, followed by monthly or quarterly vesting over a 3–4 year vesting period.

- Ask: What happens if I leave the company early? What happens if the company is sold or goes public?

- Are there provisions for accelerated vesting upon a sale or change of control?

Also, understand the tax implications. With stock options, you may owe taxes on the exercise price, even if the shares aren’t liquid. RSUs, on the other hand, are taxed when they vest.

This is why understanding your equity compensation is just as important as understanding your salary.

3. Align Your Compensation Package With Your Personal and Professional Goals

Cash for Security, Equity for Wealth

This is the part no one talks about enough: the right offer is the one that fits your life. Not just your career.

- Need to build savings or support a growing family? Consider pushing for higher cash comp and limiting your exposure to high-risk equity offers.

- Comfortable financially and bullish on the company’s future? This may be the time to prioritize more equity.

Your financial advisor can help assess whether you have enough cash on hand to take a swing at future growth.

Consider the Stage of the Company

- Public companies: You know what the equity is worth; shares are liquid, valuations are transparent, and exits are easier.

- Private companies (especially pre-IPO or Series C): Equity is more speculative. You’re betting on an eventual exit, which may take years, or never happen.

If you’re joining a private company, make sure to ask about:

- Current valuation

- Recent funding rounds

- Historical exit data

- Company’s growth strategy

The goal is to identify whether the equity you’re being offered has real value or just perceived value.

4. How to Negotiate Executive Compensation Like a Pro

If you're going to negotiate executive compensation, you need a plan.

Build Your Negotiation Strategy

Here’s the step-by-step framework I use with clients:

- Do your research: Use tools like Levels.fyi, Glassdoor, and public filings to understand your market value. Research the typical compensation for similar executive roles in your industry and location to understand market value.

- Break down the offer: Don’t focus on the total number. Separate base salary, cash bonuses, equity, vesting schedule, and benefits.

- Model different scenarios: Use a calculator to compare scenarios with more cash vs. more equity. This reveals the real value of the offer under different company outcomes.

- Prepare your counter offer: Focus on alignment, not just asking for more. “Here’s how we get closer to what I need to feel confident signing.”

If you're not sure what your target package should look like, that's where working with a good career coach or compensation expert helps.

5. Evaluating Job Offers Beyond Just the Money

A job offer is more than just a number. Consider:

- What is the actual breakdown of total compensation?

- Are the responsibilities aligned with your goals?

- Do the company’s values and culture align with yours?

- What happens if the company doesn’t hit its milestones? What if they do?

I’ve seen too many executives accept big equity packages without understanding the vesting schedule, exit plan, or funding status, only to discover that their options are worthless five years later.

Always compare against:

- Your current salary expectations.

- Comp from similar roles at similar firms.

- The future growth potential of the company.

6. Crafting a Counter Offer That Gets Taken Seriously

A counter offer is a standard part of the negotiation process, especially for executives. At this level, companies expect it and often leave room in their initial offer for adjustments. The key is to present your counter in a way that feels thoughtful, data-driven, and aligned with the company’s goals.

Your Counter Offer Should:

- Reflect your priorities – Be clear about what matters most to you (e.g., more cash for near-term needs, more equity for long-term upside, adjusted vesting terms, etc.). Don’t counter just to increase the number, tie it to your actual goals.

- Be data-backed – Use credible sources like Levels.fyi, The Salary Negotiator calculator, or comp benchmarks from similar private company or public company roles to justify your ask.

- Be solution-oriented – Frame the conversation as “how we get closer to an agreement,” rather than “why the current offer doesn’t work.” This keeps the tone collaborative and shows you’re invested in the opportunity.

I often coach clients to use language like:

“Based on my research, and the value I believe I’ll bring, I’d feel confident accepting an offer that includes XYZ…”

This type of framing signals that you’ve done the work, understand your market value, and are focused on creating a win-win solution rather than just asking for more money. And in my experience, this approach earns more respect and better results.

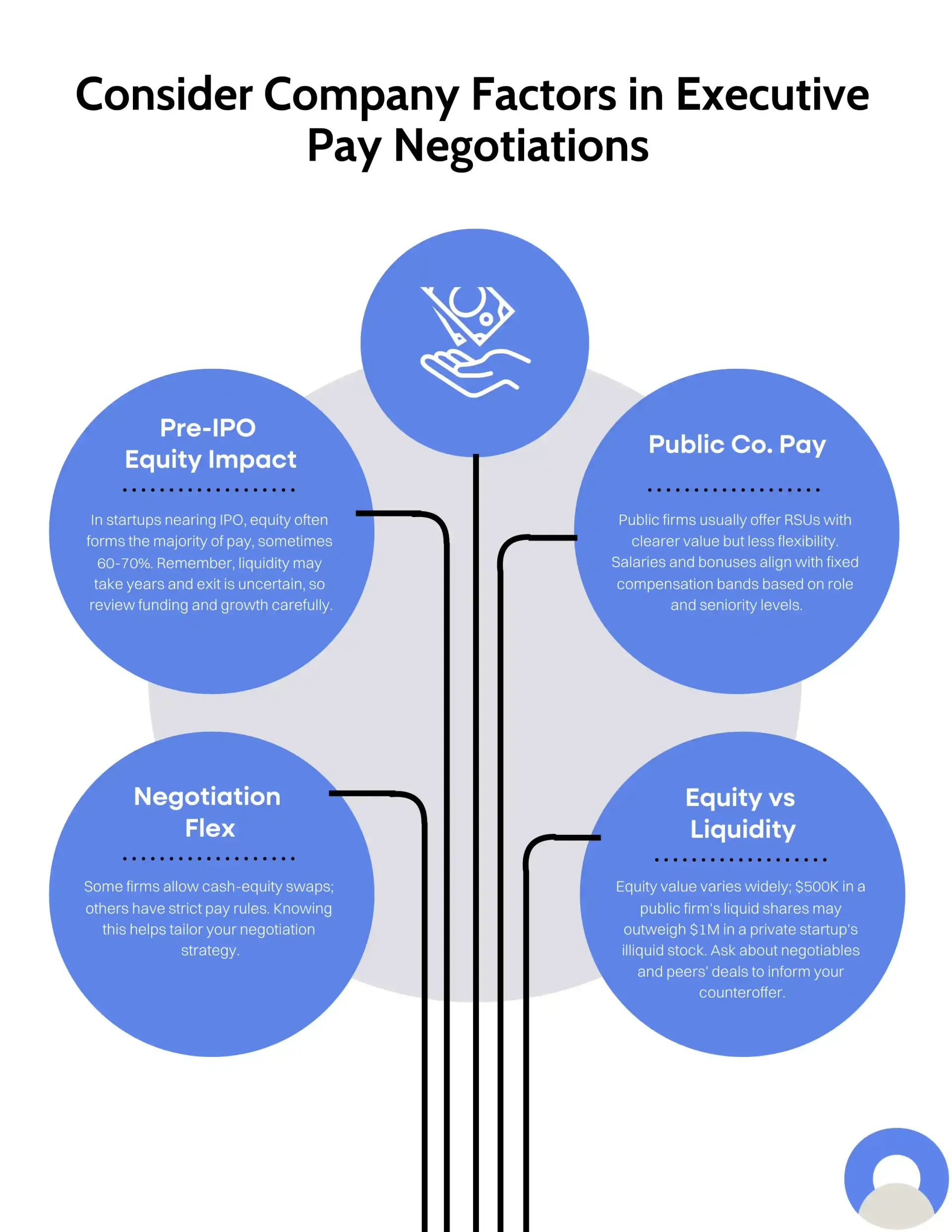

7. Factor in Company-Specific Considerations

Every company is different, and so is every executive compensation package. What’s negotiable at one firm might be non-negotiable at another, especially when comparing private companies to public companies.

- In pre-IPO companies, equity might account for 60–70% of your total compensation. That can sound appealing, but keep in mind: liquidity could be years away, and there's no guarantee of an exit. You'll want to dig into funding history, investor confidence, and company growth projections to understand how realistic that upside is.

- In public companies, your offer may include RSUs instead of stock options, and the value is easier to quantify. But the structure tends to be less flexible. Base salary, cash bonuses, and equity allocations are usually tied to level-based comp bands.

- Some firms are open to tradeoffs, offering more cash if you ask for less equity, or vice versa. Others stick to a rigid structure. Understanding how the company approaches comp philosophy is critical to crafting a smart ask.

Also, remember that perceived value differs across company types. A $500K equity grant in a public company may be worth more today than a $1M grant in a Series C startup, simply because one is liquid and the other isn’t.

Pro tip: Ask what’s flexible, what’s not, and what other execs at the company typically negotiate. The more you understand how the company thinks about compensation, the better you can tailor your counter.

8. Don’t Skip Negotiation Preparation

At Broda Coaching, I tell all my clients that if you don’t prepare, you’re giving up leverage, and potentially leaving real money on the table. Walking into a negotiation without a plan puts you in a reactive position instead of a strategic one.

Here’s what to have ready:

- A few compensation plan options

Think through 2–3 versions of an offer you'd be happy with. For example: - One with higher base salary and less equity

- Another with lower cash but

more equity

Being flexible shows you're collaborative and solutions-focused. - Your walk-away number

Know the minimum amount of cash compensation you need to cover your lifestyle and financial responsibilities. This should include base pay, bonuses, and cash flow needs. - What similar roles pay

Research market value using sites like Levels.fyi, Glassdoor, or past company offers. If it’s a private company, ask what’s typical for execs at your level. This gives you context for your ask. - How much equity you’re willing to trade

Decide in advance how much equity you’d be comfortable giving up in exchange for more cash, or how much cash you’d give up for a bigger ownership stake. This depends on your risk tolerance and belief in the company’s future growth.

Preparation makes a big difference. It helps you stay clear, calm, and focused so your negotiation feels like a business conversation, not a guessing game.

9. Effective Communication Is a Game-Changer

Great negotiation isn’t about being the loudest voice in the room, it’s about creating alignment.

When you approach the conversation with clarity and collaboration, it signals that you’re not just focused on what you want, but also on what makes sense for the company.

Use language that’s clear, confident, and constructive. For example:

- “Here’s what I’m hoping we can align on…”

- “I understand there are budget considerations, so here’s a version of the package that could work for both sides…”

- “What flexibility exists around equity or cash compensation at this level?”

Also, ask questions to understand their perspective:

- “How does this compare to other offers you've made for similar roles?”

- “What does success look like in this role, and how can compensation reflect that?”

This approach:

- Builds trust with decision makers – They see you as someone who understands the business.

- Positions you as a thoughtful leader – You’re engaging like an executive, not just a candidate.

- Makes the negotiation smoother (and more successful) – Collaboration often opens more doors than confrontation.

Even if you don’t get everything you ask for, this tone earns respect and sets a strong foundation for your role once you step into the company.

10. Risk Management: Bet Smart, Not Blind

Equity compensation can be a powerful wealth-building tool, but it comes with risk. The key is to treat it like an investment, not a guarantee.

Every offer involving stock options, RSUs, or performance shares should be evaluated through a risk lens. You’re not just joining a company, you’re betting on its future growth.

Ask the Right Questions:

- What is the company’s burn rate?

How long can they operate before needing more funding? - How many funding rounds have they raised?

Series A? Series C? This helps you gauge their maturity and remaining runway. - What does the cap table look like,and where do I sit on it?

Are you getting common or preferred stock? How diluted will your stake be?

These questions help you assess the real value and exit potential of your equity compensation.

Also Plan For:

- What happens if you leave before your shares fully vest?

You’ll likely lose unvested equity. Know what’s at stake before making a move. - What if the company delays an IPO or exit?

You could be locked into illiquid equity for years. Make sure your cash compensation is strong enough to sustain you in the meantime. - What if the stock drops in value?

If you’ve exercised options at a high strike price, and the company’s value falls, your equity could be underwater.

Bottom line: Equity isn’t a lottery ticket, it’s a calculated bet. The more you understand the risks, the smarter your decisions will be.

Frequently Asked Questions (FAQ)

How do I determine the actual value of equity in a private company?

Determining the real value of equity in a private company can be tricky because there’s no public stock price. You’ll need to ask the company for:

- The most recent 409A valuation

- The current number of shares outstanding

- Your percentage ownership post-grant

- Any liquidity forecast or expected exit timeline

From there, you can estimate how much your shares might be worth. Just remember, it’s speculative until there’s an exit like an acquisition or IPO.

What’s the difference between stock options and RSUs from a risk perspective?

RSUs (Restricted Stock Units) are typically less risky because they’re actual shares (or their cash equivalent) granted to you upon vesting. You don’t need to purchase them.

Stock options allow you to buy shares at a set strike price. You only make money if the company’s value exceeds that strike price in the future. In early-stage companies, this offers more upside, but also more risk.

If I negotiate for more equity, should I ask for fewer performance conditions?

Ideally, yes. If you're trading cash for more equity, you should try to ensure that equity isn’t tied to unrealistic performance milestones. You’re already taking a financial risk, don’t stack operational uncertainty on top of that. Always clarify the conditions attached to vesting and advocate for fair, measurable goals.

How do I balance short-term needs (like cash flow) with long-term wealth goals?

Use a basic framework:

- If you need to cover monthly expenses, fund kids’ education, or build your emergency fund, prioritize cash compensation.

- If those bases are covered, and you're aiming to boost long-term net worth, consider taking more equity, particularly if you believe in the company’s future growth.

It’s not all or nothing. A well-negotiated executive compensation package should strike the right balance between immediate needs and long-term upside.

Can I negotiate my vesting schedule?

In many cases, yes, especially at startups and private companies. You may be able to negotiate:

- Shorter cliffs (e.g., 6-month cliff vs. 1-year)

- Front-loaded vesting (more equity in years 1–2)

- Accelerated vesting upon a change of control (e.g., company sale)

Just know that not all companies will agree to changes, especially if they have a standardized compensation plan. But it’s worth asking.

What happens to my unvested equity if I leave the company early?

In most cases, unvested equity is forfeited when you leave before it fully vests. However, some companies offer partial vesting or have terms around accelerated vesting in specific cases (e.g., termination without cause, company acquisition). Review the equity agreement closely, and ask for clarification if anything is unclear.

Should I consult with a financial advisor before accepting the offer?

Yes. A financial advisor or compensation expert can help you evaluate the offer holistically, including tax implications, long-term wealth modeling, and exit scenarios. It’s especially helpful when deciding how much equity to take on versus securing more cash. Negotiations often include discussions about benefits and perks.

Is equity still valuable if the company doesn’t go public?

Yes, but only if there’s another liquidity event (e.g., acquisition, secondary share sale, internal buyback). Without one, your vested options or restricted stock may sit idle indefinitely. This is why it’s so important to understand the company’s exit strategy, not just the size of the equity grant.

What’s the biggest mistake executives make during negotiations?

The biggest mistake? Focusing only on the top-line number. Many execs chase a big equity package without:

- Accounting for tax liabilities.

- Modeling worst-case scenarios.

- Understanding the vesting schedule.

- Evaluating whether the company can realistically grow.

Always ask: “What would this offer look like if the company underperforms?”

Final Thoughts: There’s No Perfect Offer—Only the Right One for You

When it comes to how to negotiate smarter as an executive: equity vs cash, the smartest move isn’t chasing the biggest number. It’s designing a compensation plan that fits your career, your lifestyle, and your future. Choosing between cash and equity is a personal decision that should align with long-term goals.

Here’s what I tell every client:

Don’t assume equity is automatically better. Do your research. Equity is an investment—ask yourself how much of your income you're willing to risk on this company's future.

And if you’re stuck, overwhelmed, or just want a second set of eyes, talk to a financial advisor or career coach. A little guidance can help you unlock hundreds of thousands, sometimes millions, over time.

If you're looking to secure the next executive role in your career or need guidance negotiating your executive compensation package, Apply Now to see if you're a good fit to work with my team and I.